22+ trid mortgage meaning

The Know Before You Owe Rule. Web TRID Purpose.

Home Buying 101 What Is Trid Highland Homes

Contact Zachery Adam for more information about TRID.

. Ability to RepayQualified Mortgage Rule provides access to the details on the sections of Regulation Z Truth in. TRID is an acronym that some people use to refer to the TILA RESPA Integrated Disclosure rule. Web The ATRQM rule operates under the legal presumption that creditors originating the QMs complied with ATR rule requirements.

The Trusted Lender of 300000 Veterans and Military Families. TRID is an acronym that stands for TILA-RESPA Integrated Disclosures. So its assumed the lenders.

Web The Truth In Lending Act known as TILA or Regulation Z protects consumers from closing cost abuses by standardizing the way mortgage terms and fees are calculated and. TRID is a new Rule which applies to most residential mortgage transactions that combines the Good Faith. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web TRID stands for TILA-RESPA Integrated Closing Disclosures. TRID was developed with the intent to allow potential homebuyers to easily shop for the best deal. Web The questions and answers below pertain to compliance with the TILA-RESPA Integrated Disclosure Rule TRID or TRID Rule.

Web What Is A Principal Reduction. Web What does TRID mean. Web TRID also included compliance rules for the lender requiring them to provide the consumer with clear information about the mortgage they were applying for.

Ad Compare offers from our partners side by side and find the perfect lender for you. Web The TRID is an example of government agencies trying to make life easier for homebuyers. As an alternative to foreclosure a.

Web Ability-to-RepayQualified Mortgage Rule. Since this rule is designed. A principal reduction PR is a reduction in the amount owed on a loan most often a mortgage.

This rule is also known as the Know. TRID or TILA-RESPA Information Disclosure informs consumers applying for a mortgage and defines compliance rules for lenders. Web construction is completed in which the loan amount is amortized just as in a standard mortgage transaction can be covered by the TRID rule if the coverage.

This is a Compliance Aid issued by the Consumer. We have all been talking about the TILARESPA Integrated Disclosure rule also known as TRID.

The Importance Of Trid When It Comes To Real Estate Closings

What Is A Mortgage First Let S Define The Word

Mortgage Knowledge Pensil Trid Home Loan Toolkit Tila Help Passing The Nmls Exam Youtube

Loan Originator Pre Licensing And Exam Prep

Know Before You Owe New Mortgage Disclosures New Rule Consumer Financial Protection Bureau

20 Hour Safe Loan Originator Pre Licensing Slides 2017 2018

Oncourse Learning Helps Accelerate New Hire On Boarding For Mortgage Lender Oncourse Learning

The Importance Of Trid When It Comes To Real Estate Closings

What Is Trid And How Does It Affect Purchase And Refinance Mortgages

What Is Trid Its Purpose Explained Youtube

Understanding Trid And What It Means For The Mortgage Industry

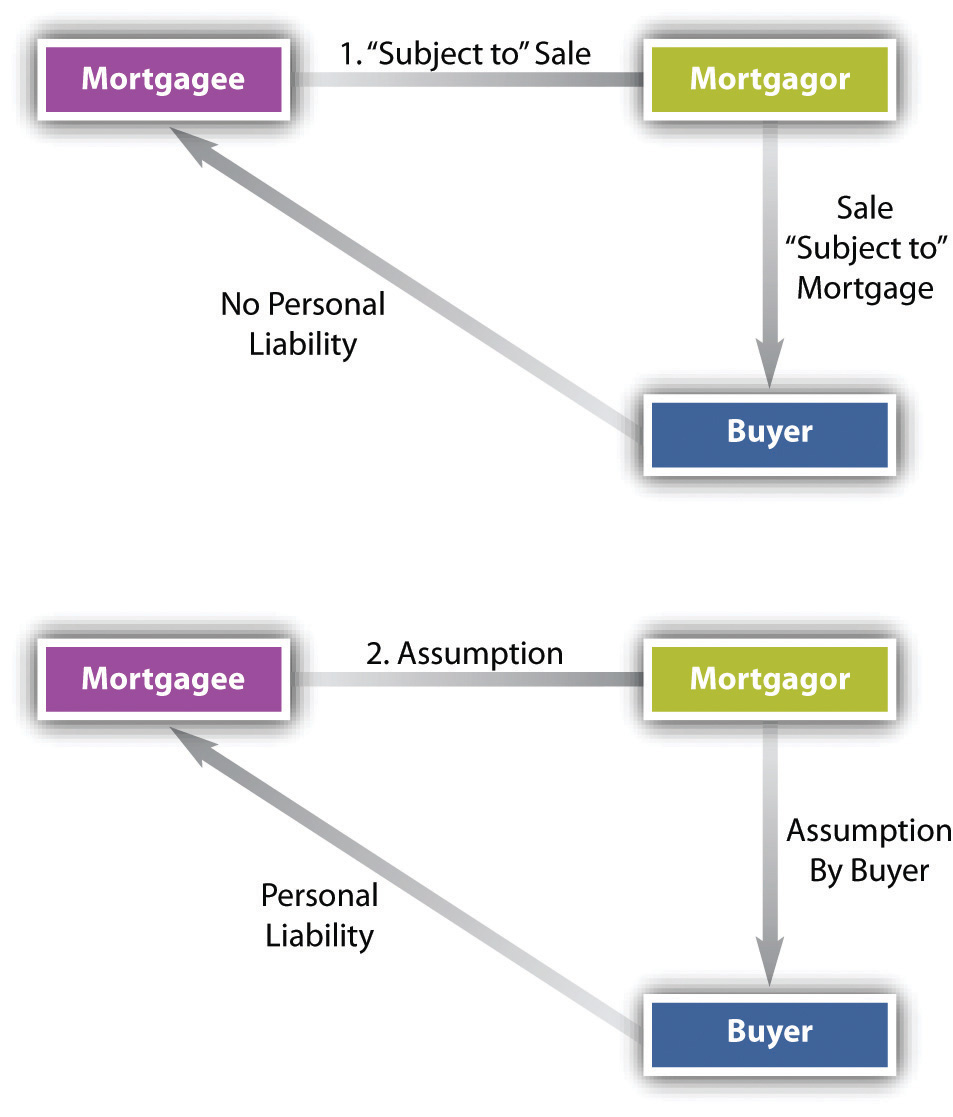

Priority Termination Of The Mortgage And Other Methods Of Using Real Estate As Security

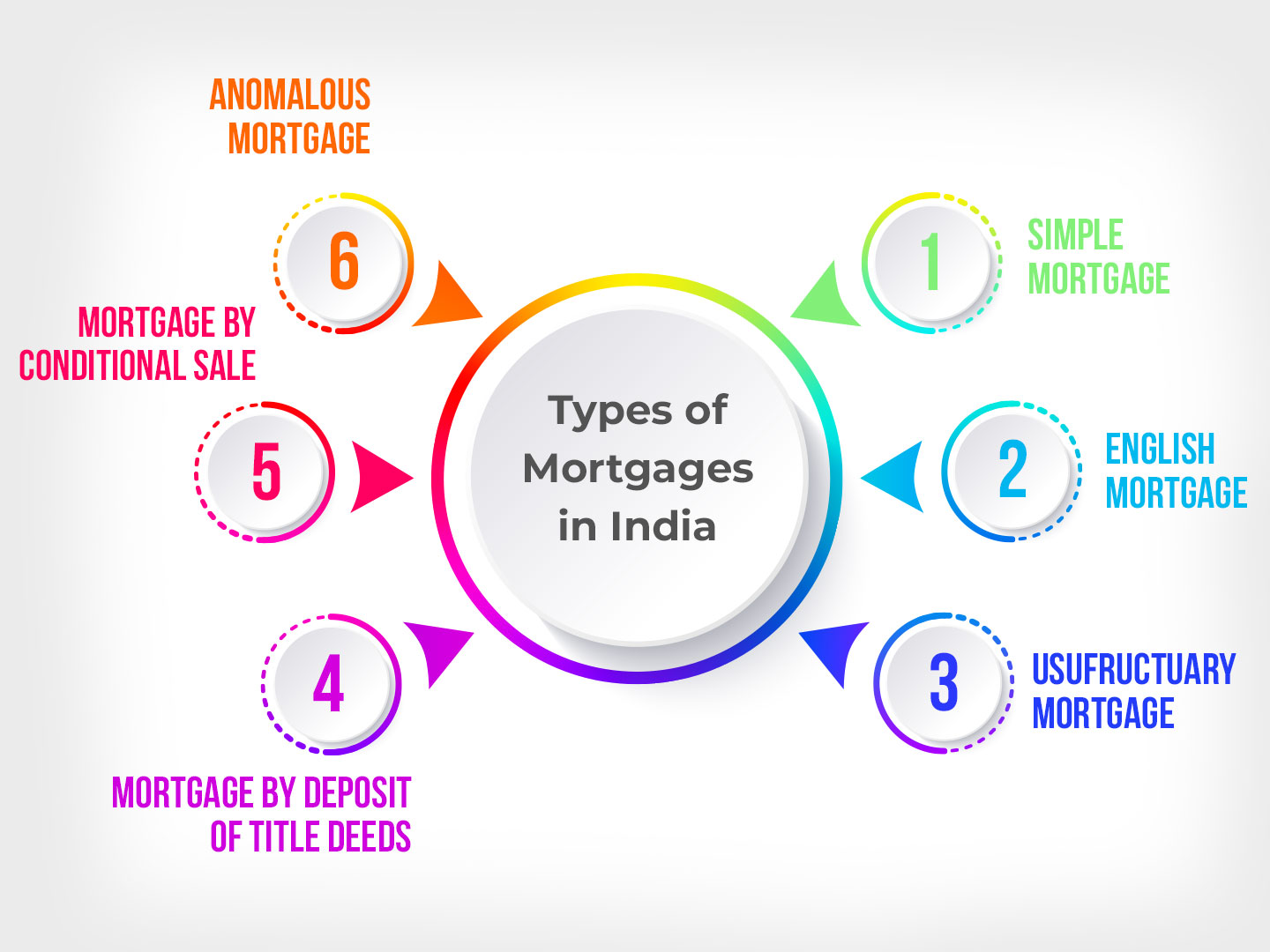

What Are The Different Types Of Mortgages In India

Tila Respa Integrated Disclosures Trid Zillow

What S Trid And Why The Heck Should I Care Movement Mortgage Blog

Trid What Is Trid Tila Respa

Mortgage Compliance Checklist